Let’s be honest. When you’re facing major surgery, your mind is on your health, not your wallet. You’re thinking about recovery, pain, getting back to your life. But here’s the deal: the financial side of a major procedure is a maze all its own. And if you don’t have a map, you can get lost in a jungle of bills you never saw coming.

It’s not just about the surgeon’s fee. That’s just the tip of the iceberg. The real challenge—and honestly, the stress—comes from navigating the hidden costs of surgery that lurk beneath the surface. Think of it like planning a big home renovation. You budget for the contractor, but then the plumbing’s shot, the wiring isn’t to code, and you need a place to stay while the work’s being done. Surgery can feel a lot like that.

The Sticker Shock: Understanding Your “Official” Bill

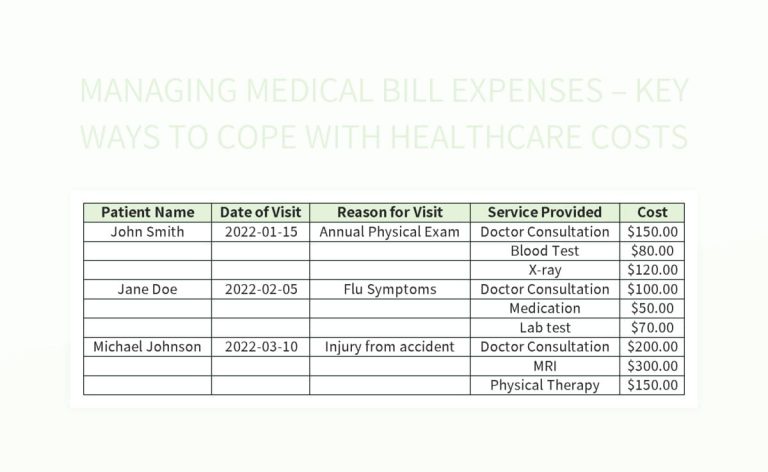

First, let’s break down the line items you expect to see. These are the upfront costs of surgery, though “upfront” is a funny term since the bills trickle in for months. You’ll likely get separate invoices from different players, a practice called “balanced billing” that can be utterly confusing.

- The Surgeon’s Fee: Payment for their skill and time in the operating room.

- Hospital/ Facility Fees: This is the big one. It covers the operating room, the bed, the nursing staff, and basic supplies. It’s often the largest portion of the bill.

- Anesthesia Fees: A separate charge from the anesthesiologist or nurse anesthetist. Crucial, but billed independently.

- Diagnostic Tests: Pre-op blood work, X-rays, MRIs—they all add up.

The Network Trap: In-Network vs. Out-of-Network

This is where people get burned. Your hospital might be in-network. Your surgeon probably is, too. But what about the anesthesiologist? The pathologist who reads your tissue samples? The assistant surgeon? They might be out-of-network contractors, leading to “surprise medical bills.” Legislation has helped, but gaps remain. You have to ask—who will be in that room, and are they all in my plan?

The Hidden Costs of Surgery That Blindside You

Okay, now for the stuff they don’t put on the brochure. The real-world financial impact of surgery that hits your daily life. These are the costs that can drain savings even if your insurance “covers” the procedure itself.

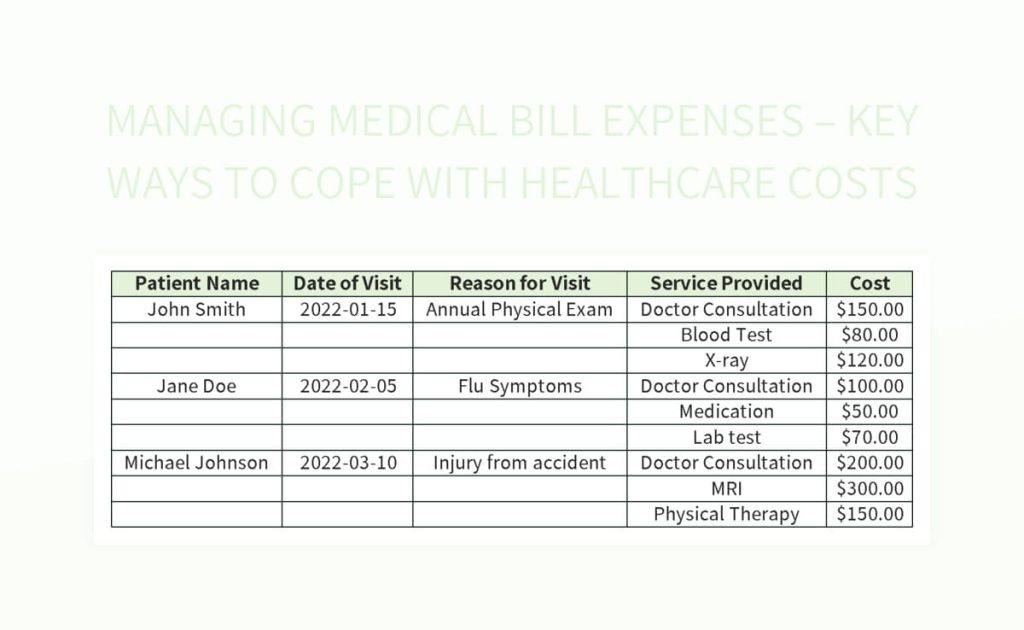

| Cost Category | What It Includes | Why It’s Often Overlooked |

| Pre-Surgery Costs | Consultations, second opinions, pre-hab physical therapy, special diets or supplements. | Seen as separate from the “main event.” Insurance may not cover second opinions or wellness prep. |

| Lost Income & Productivity | Time off work for you and a caregiver. Short-term disability may not cover 100%. | We optimistically think we’ll bounce back faster. Recovery is often longer and more tiring than advertised. |

| Post-Op Care & Supplies | Prescription medications, wound care supplies, compression garments, durable medical equipment (cane, walker, shower chair). | These are purchased at home, often from different retailers. Co-pays for new, stronger pain meds can be steep. |

| Home & Lifestyle Adjustments | Meal delivery services, hiring help for cleaning/lawn care, home modifications (grab bars, ramps), extra childcare. | You don’t know what you’ll need until you’re in it. Pride makes us underestimate the help we’ll require. |

| Travel & Lodging | Gas, parking fees (a fortune at city hospitals!), hotel stays for a caregiver if the hospital is far. | Seems incidental, but parking alone can cost $20+ a day for weeks of follow-up visits. |

See what I mean? It’s the drip, drip, drip of expenses. That $40 antibiotic co-pay here, a $80 shower chair there, $200 for a week of healthy pre-made meals because you can’t stand to cook… it adds up to a real financial burden.

Your Action Plan: How to Mitigate the Financial Impact

Feeling overwhelmed? Don’t. Knowledge is power. Here’s a practical, step-by-step plan to navigate this.

1. Interrogate Your Insurance (Politely, Of Course)

Call them. Get a detailed, written pre-authorization and cost estimate. Ask: What’s my deductible? My out-of-pocket max? Are pre- and post-op therapies covered? What DME (durable medical equipment) is covered, and through which vendor? Get CPT codes from your surgeon’s office and run them by your insurer.

2. Have “The Talk” With Your Care Team

Be blunt with your surgeon’s billing coordinator. “Can you provide a detailed estimate?” “Will everyone involved be in-network?” “Are there less expensive but equally effective implant or device options?” Hospitals often have financial counselors—use them. They can sometimes negotiate rates or set up payment plans before the surgery.

3. Build a Realistic “Life Budget”

Beyond the medical bills, sit down and map out 2-3 months of living expenses. Factor in reduced income. Research costs for anticipated help and supplies. Start setting aside money now, even if it’s just a little. Consider using a Health Savings Account (HSA) if you have one—it’s tax-advantaged for these exact costs.

4. Get Creative With Support

Let people help you. Set up a meal train. Ask a neighbor to walk the dog. Trade childcare with a friend. Look into non-profit grants or assistance programs for specific conditions. There’s no trophy for suffering through this alone, financially or physically.

Wrapping Up: The True Cost of Healing

At the end of the day, navigating the financial aspects of major surgery is an act of self-care as much as choosing the right surgeon is. It’s about preserving your peace of mind so you can actually focus on getting better. The stress of unexpected debt can, frankly, slow your recovery.

The goal isn’t to scare you—it’s to empower you. To shift your mindset from a passive patient to an active project manager of your own health and finances. Because the real hidden cost isn’t just in dollars; it’s in the anxiety of the unknown. And that’s one cost you can, with some gritty preparation, avoid paying.